Rent increases are a part of life for rental property owners and their tenants. While it will never be considered a favorite part of the landlord/tenant relationship, attention to the following do’s can make the process less painful for all involved. The key is to consider several factors before getting to the “rent increase letter.” …

Category: Landlord Education

The Do’s of a Rent Increase

Mold Prevention Tips for Landlords

Mold is difficult to detect, expensive to remove, and is responsible for a myriad of health issues. The silent cause of damage to structures and a host of symptoms and health concerns. Landlords are compelled to offer dwellings free of health hazards, including the presence of mold. If left unchecked, the harm mold inflicts …

The Pros and Cons of Renting to College Students

Many a rental property owner comes face to face with the question: Should I rent to college students? For some, the very thought conjures images of loud, late-night parties and disorderly conduct. Others might offer property destruction and late rent payments as cause for steering clear of student tenants. Even though these commonly held notions …

Continue reading “The Pros and Cons of Renting to College Students”

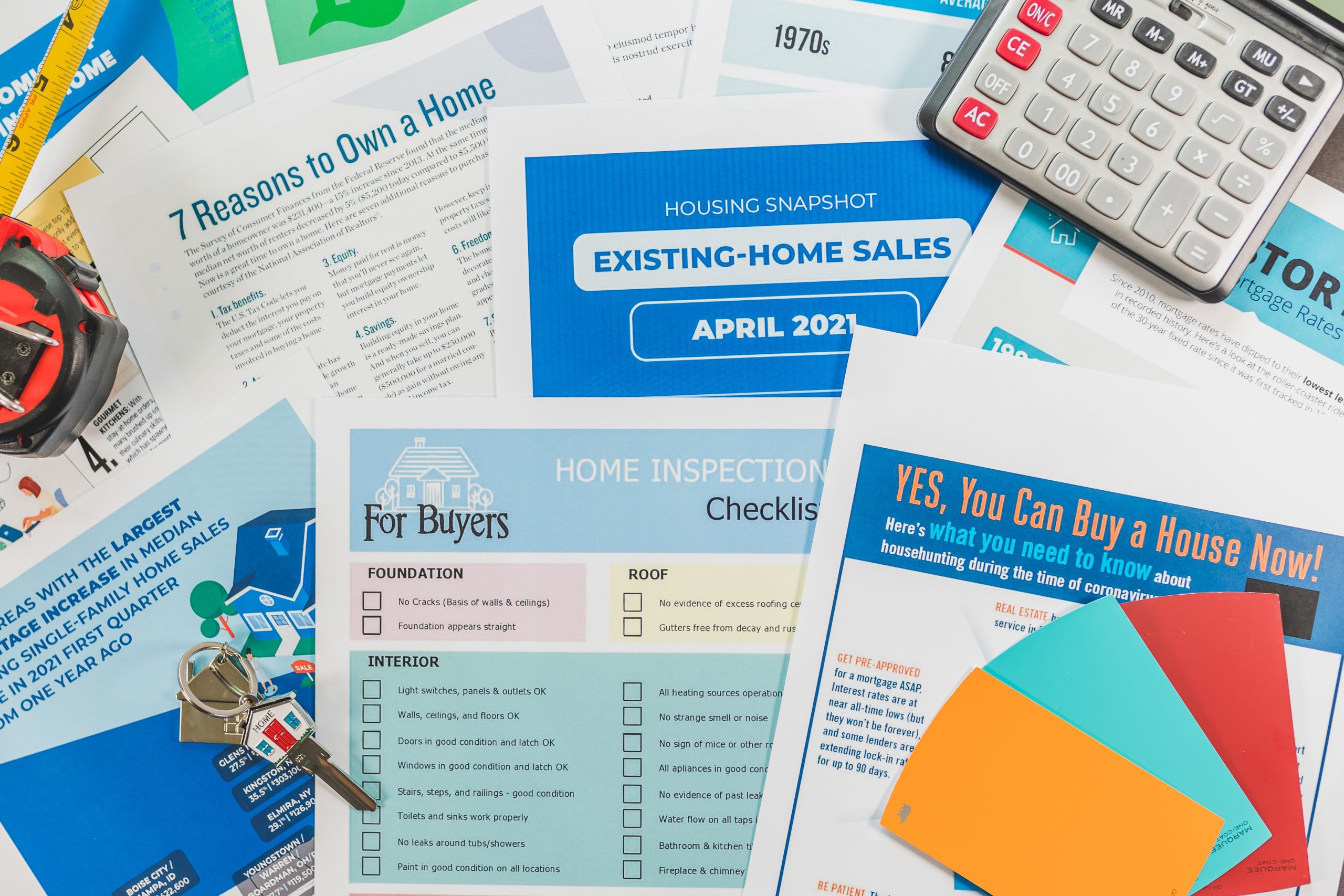

Tips for Determining How Much Rent to Charge

Both first-time and experienced landlords face the dilemma of establishing rental prices for their property. Set the rent too high, and units will sit empty, earning nothing while still accumulating expenses via utilities, taxes, insurance, etc. Charge too little in rent, and red ink will dominate your profit and loss statement again. The prospect of …

Continue reading “Tips for Determining How Much Rent to Charge”

What Happens When a Tenant Dies?

Yes . . . What does happen? Some landlords have never considered facing that situation, while other property owners consciously choose not to think about that scenario. Still, all would have to admit that it’s better to be prepared than to be caught off guard. So, how about we dive into answering that very question. …

Book Review: What Every Real Estate Investor Needs to Know About Cash Flow . . .And 36 other Key Financial Measures – Frank Gallinelli

If you are a real estate investor, this is the book! As one reader says, “It’s a must-have reference for anyone from new to seasoned investors.” Gallinelli divides his book into two parts. In part one – Chapters 1-6, Gallinelli discusses the various topics investors need to understand. In chapters one and two, we discover how …

4 Tips for Keeping Tenants Happy

FACT: Empty rental units do not make money -they cost money in lost revenue and new-tenant renovation/improvement costs. In addition, they can eat up big chunks of a landlord’s time. Long-term tenants are the key to increasing revenue and profitability. Period. But how to achieve tenant longevity is the question. Some of the reasons tenants …

6 Ways to Market your Rental Property

Vacant rental properties are the bane of every landlord’s existence. Of course, vacancies will happen as that’s the nature of the rental property business. But to maintain adequate cash flow and make a profit, those vacancies must be short-term. New tenants must first be attracted to your property before they can be screened, approved, and …

3 Strategies for Managing the Appliance Shortage

As supply chain shortages ricochet across the country, property owners face appliance shortages and price increases on parts and repairs for the essential systems in their rental units. Demands surged for all types of appliances in the early days of the pandemic as folks hunkered down at home and tackled home improvement projects. Unfortunately, this …

Continue reading “3 Strategies for Managing the Appliance Shortage”

Best Bets for Communicating with Tenants

Collectively battling the COVID-19 virus these past two years has impacted the landlord/tenant relationship in multiple ways, one central area being communication dynamics. As is true for many of our relationships, maintaining a healthy connection has required continual shifting of strategies to accommodate an ever-changing environment. If that sounds like a lot of work, that’s …